Perhaps we shouldn't think too hard about this question however. Thousands of civilizations have existed for tens of thousands of years. They have existed in all corners of the Earth. They have spoken many languages and held many beliefs. But most, if not all, of these civilizations have arrived at one currency: Gold. Perhaps a more accurate description would be precious metals, with Gold and Silver being the most popular.

Precious metals make sense for a number of reasons. They are a finite resource and cannot be created by any person. They are easily worked into many different forms. Their relative scarcity assigns them a high value density, meaning they are very portable as a currency.

But as I pondered this issue I was bothered by something. If Gold is a finite resource, doesn't that imply that people will continually grow poorer as the population increases? If there are more people, there is less Gold to go around. It took me some time to get past this. Eventually it hit me; currency is not a means of wealth. Currency is a means of transaction. This epiphany suddenly put the puzzle together for me.

Imagine a small economy many years ago, perhaps a village of 10 farmers. Each farmer works all day to grow enough food for himself. There is no transaction, no need for currency. Now lets assume the population explodes to 20 farmers. Again, each works all day to grow his own food. The total economy has grown, but the economic output per person is the same. In addition, the production and consumption are equal, meaning there is no trading, exporting, importing, saving, or growth. The economy is at steady-state and could remain stable forever.

At some point, one of the farmers decides that there must be an easier way to farm. He spends his free time building a plow, attaches it to his horse, and suddenly he can produce twice as much as everyone else. He builds nine more plows and gives them to the other farmers in exchange for other goods. Now 10 farmers can feed the village of 20, thus freeing up the time of the other 10 villagers. They find new means to be productive, perhaps hunting, fishing, or building homes. This illustrates a fundamental point in economics: the only way an economy can grow is through technological advances.

Thinking further about the impact of technology we realize that as technology advances, the price of goods decrease. After the farmer invented his plow, the price of his crops eventually decrease. This is because the only "real" value in this world is the value of our time and efforts. If new technology allows us to produce more with less efforts, then prices fall. So, as the economy grows through technology, less of our currency will be used to trade basic goods, leaving more currency for new population growth, lifestyle improvements, or to be invested in yet newer technologies.

Wealth is not measured by currency; wealth is measured by lifestyle. Currency is a means of achieving wealth through lifestyle improvements, but currency is also used to purchase basic goods and invest in new technologies. If the population grows, more currency is diverted into basic goods. Therefore, what the economy really represents is a delicate, permanent balance between population, lifestyle, and technology.

All of these fundamentals will apply to an economy, if the currency is fixed in total quantity. As I've mentioned, this is one reason Gold has been used for thousands of years. What if that weren't true? If Gold was our currency, and somebody stumbled upon a new mine, they would certainly be rich. They could use the new Gold to dramatically improve their lifestyle and even to invest in new technology and help the economy grow. But, eventually the "value" of the currency would decline as it is realized by the whole population to be less scarce than previously known.

So, the moral of this story is simple: If any single person or group of people are allowed to create currency at their own discretion, it is reasonable to assume that they themselves will profit greatly at the expense of everyone else. The Federal Reserve has been assigned the task of managing our currency for nearly 100 years now. It might surprise people to learn that the Federal Reserve is a privately held corporation, and not a government entity. So lets take a quick look at how the Fed has done managing our currency, and try to understand why Ron Paul wants to abolish them and return us to Gold.

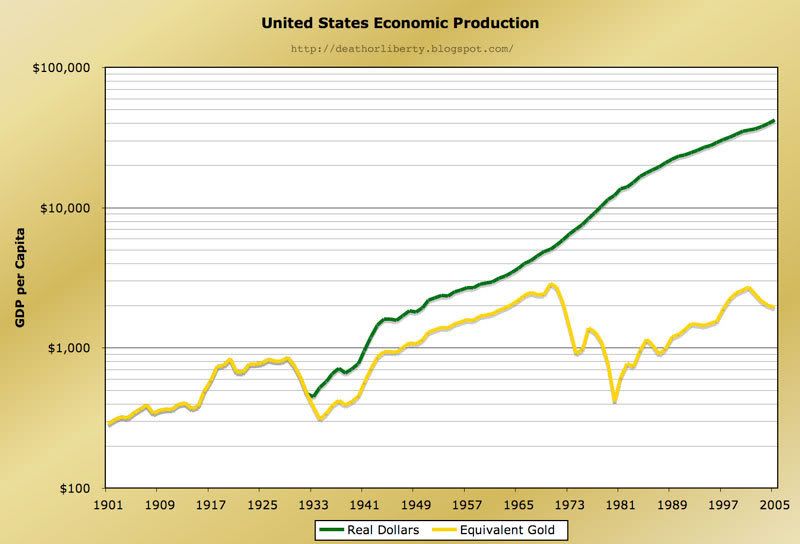

The first graph here is our economic output per person since 1901, in both Gold and US Dollars. According to this data, the average person in the US today produces approximately $40,000 per year in goods and services. This seems perfectly reasonable to me. But, seeing that the number was only about $300 in 1901, it would indicate that technology has allowed us to be 133 times more productive than we were 100 years ago. This is not likely the case.

We can see here that the US Dollar was historically linked to the value of Gold. This is why the lines overlap until 1933. But, as the government eroded the Gold standard and the Fed took full control of our currency we see that the economy in Dollars began to soar. What this really indicates is that the dollar was losing its value. If we look at the gold data, we see that a person today is roughly seven times more productive than in 1901 (from $300 to $2000). Based on technological advances in the 20th century, this seems completely plausible to me. This tells me that Gold has held its value over time, but that the dollar has declined quite dramatically.

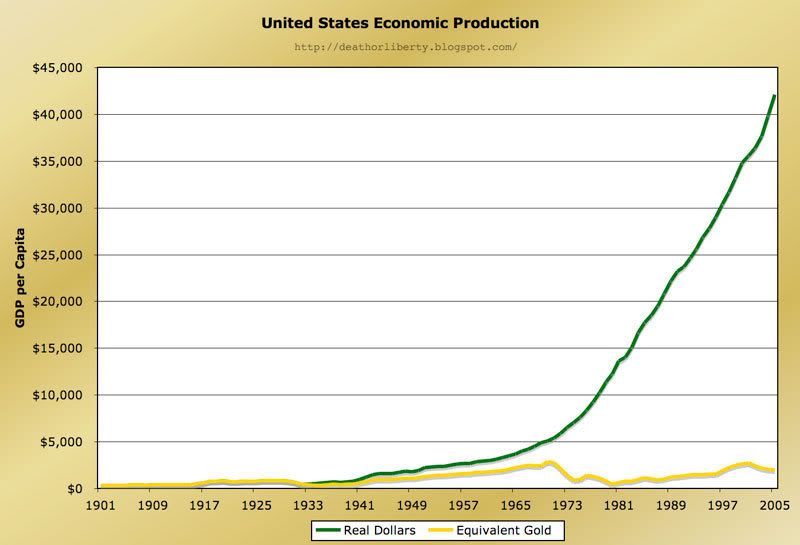

One quick point, to reiterate my last post about data presentation. The above graph is the same data presented on a linear scale. It is clear how the data is skewed in this form, and certainly adds some drama to the discussion. However, it is unfair and unnecessary.

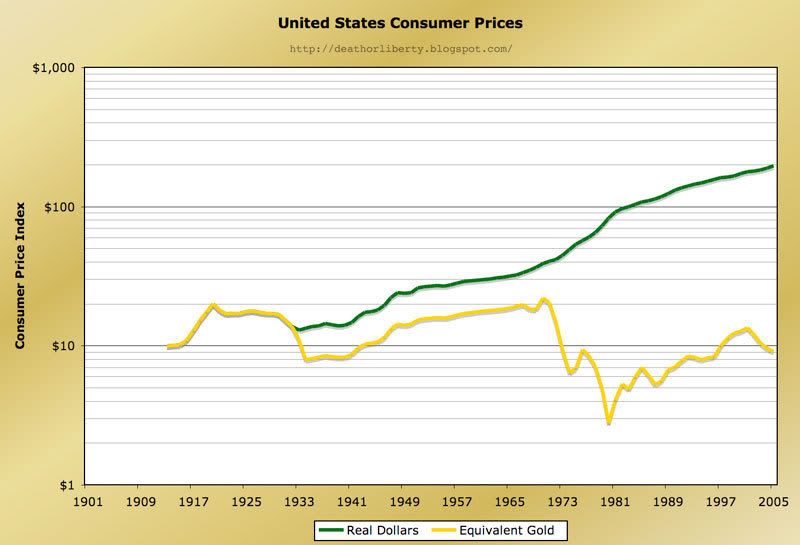

Recall my assertion that technology not only allows the economy to grow, but also reduces the prices of basic goods. As can be seen in the above graph, consumer prices have indeed fallen compared to Gold. However, prices have steadily risen when using US Dollars.

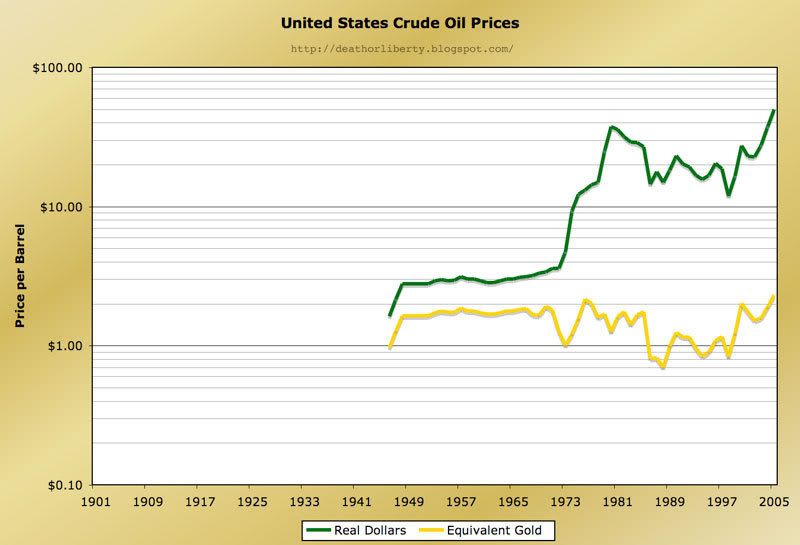

This graph shows oil prices historically. Again, the data certainly supports theories that oil prices are soaring in Dollars. But its interesting to discover that they have been relatively flat against Gold. Now, just as in consumer prices, we would expect technology improvements to lower the price of oil steadily over time. However, oil is a scarce resource and as the supply runs low the price will increase. These two effects have perhaps been canceling each other until now.

How then do we save for our future? Deflation of the currency is natural, even in gold. If technology allows you to be more productive today than yesterday, then the money you earned yesterday is not worth as much. So I wouldn't advise saving for your future by sticking Gold bars in the mattress. By investing your savings, it can be used to develop new technology and grow the economy, growing your savings along with it. But as the Fed continues to devalue our currency, I wouldn't advise saving for your future by investing in the Dollar economy either.

Perhaps the only option is to send your savings to Ron Paul and ask him to save your future. :-)

No comments:

Post a Comment